Articles

Don’t Get Hooked! Stay One Step Ahead of Phishing Scammers with These Proven Tactics

Discover the increasing threat of phishing scams and how they target individuals and organizations, aiming to steal sensitive personal data. Learn ...

Lahaina’s Darkest Hour: $50 Million Annual Property Tax Revenue Loss

The aftermath of the deadliest wildfires in the U.S. in over a century has left Maui's economy reeling, with daily losses of over $1 million in ...

Navigating the Complexities of Reporting Foreign Assets for U.S. Taxpayers

Understanding your reporting obligations for foreign assets as a US person is crucial in today's globalized world. Don't risk severe penalties for ...

Are You Prepared for Tax Season in the Gig Economy?

This article explores the tax implications of gig work and highlights the need for gig workers to be aware of their tax obligations. It also ...

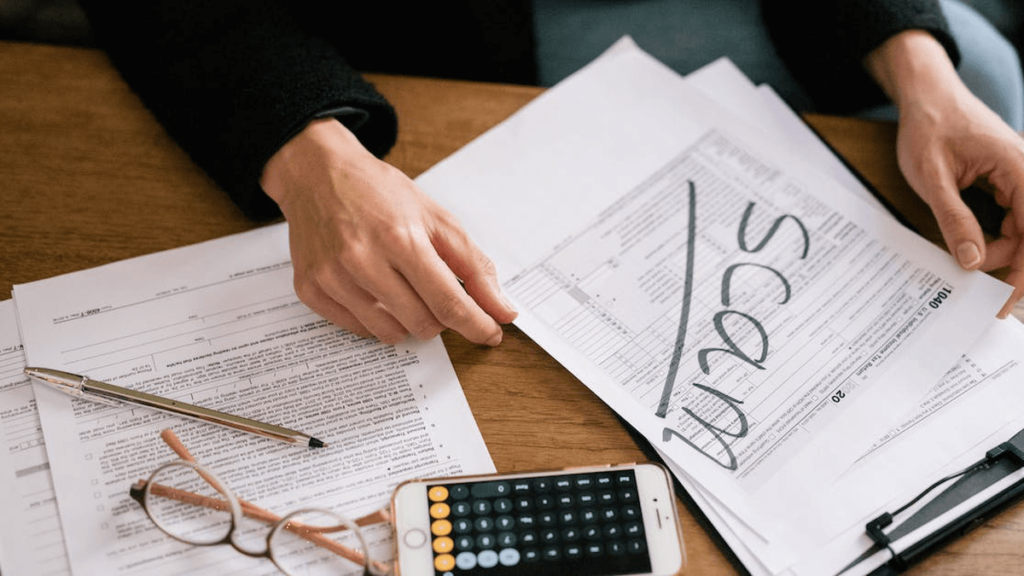

ERC Scams on the Rise

The Employee Retention Credit is a valuable relief program for businesses, but it has also attracted fraudsters who prey on unsuspecting victims. Read ...

Tax Planning Strategies for Small Businesses

“Maximizing Deductions and Tax Credits for Small Businesses”

Learn how to reduce tax liabilities and take advantage of tax credits for small ...

“Maximizing Your Business’s Value: Essential Steps to Selling Success”

"Selling Your Business? Don't Miss These Crucial Steps" walks business owners through the critical process of selling their company, from ...

Unraveling the Tax Advantages for Homeowners

Did you know that certain home improvements and medical expenses can be tax deductible? Find out how you can claim deductions for energy-efficient ...

Tax Tricks for Vacation Home Owners: Make Your Investment Work for You

Are you a vacation home owner? Find out how to make the most of your investment by understanding the tax implications of renting out your property. ...

IRS Transforms Policy: Halts Unannounced Revenue Officer Visits

The IRS's decision to halt unannounced visits by revenue officers is seen as a positive move to increase confidence in tax administration and ensure ...

The Financial Fallout of Divorce

Divorce can be a financial and legal minefield. This article offers a comprehensive overview of the tax implications, asset division, and the ...

The Rising Importance of Digital Estate Planning and Tax Regulations for Blockchain and Cryptocurrency Assets

The Importance of Digital Estate Planning and Tax Compliance for Blockchain Assets” – Discover how to safeguard your digital assets and ensure their ...

Unlock Your Business Potential: Why Changing Your Accountant is a Game-Changer

Learn how to make a smooth transition when changing accountants for your small business. From doing your due diligence to understanding the services ...

How Cost Segregation Studies Can Save Property Owners Thousands

Find out how cost segregation studies can boost near-term cash flow for property owners by deferring taxes and minimizing tax liabilities. Learn how ...

Your Guide to Tax Savings: How Hiring People with Disabilities Can Benefit Your Business

Looking to make your business more inclusive and accessible? Learn about key tax incentives, such as the Disabled Access Credit, Architectural Barrier ...